Cambridge University Workshop

The Costs of Fair Trade Textile Certification – A Global Value Chain Perspective

By Hannes Grassegger

Remark: I wrote this paper for the CRASSH Workshop on Fair Trade - A Moral Economy? at Cambridge University. If you like to get the original with all the references contact me via this blog.

1) Introduction

This paper analyses the costs of Fair Trade (FT) third party certification for clothing by examining the given industry structure and applying the Global Value Chain framework.

FT clothing certification was started in 2004, and is different to FT certification for agro-commodities, as it tackles a by far more complex industry. Thus, FT textiles certification can be regarded as a test run for the expansion of the FT system on most industrial products like computers etc. Proponents of FT often praise the system as a market based solution to obtain certain social and environmental improvements.

In popular language, the expression Fair Trade has become synonymous with ethically differentiated products that rely on social and environmental standards. “There is no legal definition of Fair Trade and no protection against counterfeit Fair Trade products” (Nicholls et al. 2005, p. 230). The Fair Trade definition according to FINE reads as follows:

“Fair Trade is a trading partnership, based on dialogue, transparency and respect, that seeks greater equity in international trade. It contributes to sustainable development by offering better trading conditions to, and securing the rights of, marginalized producers and workers [highlighted by the author] – especially in the South. Fair Trade Organizations, backed by consumers, are engaged actively in supporting producers, awareness raising and in campaigning for changes in the rules and practice of conventional international trade.”

FT thus focuses on workers and producers. It promises direct and efficient transfers of money or other measurable benefits to workers within the production process of a specific FT product. FT certification for clothing has the aim of substantially improving working conditions and demands several costly compliance measures for producers, such as higher wages. We thus expect a corresponding price increase for FT certified products.

To find out “the retail price increases that would be necessary to fully absorb the costs of substantially raising wages and/or improving working conditions for production level workers in the apparel industry” Pollin et al. (2002, p. 5) analyzed retail price effects of wage increases for staff in the production of garments. Starting from aggregated data from Mexico and the US on the share of labor costs per item at the shipping stage, they increased staff wages by a 100%. Depending on the production country and depending on whether they also doubled the wages of supervisory staff, they estimated costs, which, added to the retail price should cause price rises “ranging between 2% and 6%” (Pollin et al. 2002, p. 5). Thus, to cover the costs of doubling the wages only a very small price increase should be expected. However, actual mark-ups for Fair Trade certified clothing are by far higher. Conducting internet and storefront as well as press research, I found a plethora of offers for Fair Trade certified white T-shirts showing price increases between 160% an 360% compared to a common white T-shirt from mass retailer C&A.

The goal of this paper is to explain this huge discrepancy between the observed market prices of certified textile products and the much lower price increase that could be expected due to the FT requirements. The costs of Fair Trade certification accrue partly because of the specific production circumstances of textiles and clothing. Certifying clothes is different to certifying simple products like coffee, insofar as the production processes are more complex and sequenced. The predictions of Pollin et al. (2002) were based on two premises:

- Imposing higher wages (or better working conditions) comes at no cost.

- The production of textiles is undertaken by a vertically integrated unit.

This paper shows why both premises lead to false conclusions in the context of complex value chains such as for clothes. For this, I first give a brief overview of the clothing value chain and its properties (section 2). Section 3 presents the Global Value Chain concept, on which the assessment of cost effects of certification is based and section 4 investigates these effects in detail. Section 5 concludes.

2) Properties of Textile Value Chains

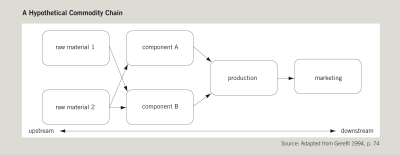

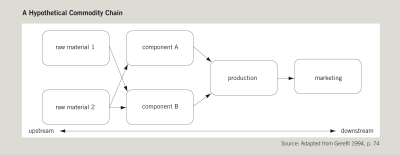

Gereffi et al. (see 2003, p. 7) divide the production process of clothing into five distinct adjacent stages:

Raw Materials: e.g. farming of cotton, bamboo, hemp, jute, linen or sisal; man-made (synthetic) production of fibers; cattle breeding of different types of farm animals for wool production.

Components: The textiles industry comprises several production stages to arrive at fabrics, also depending on the raw material. Examples are ginning (removing the seeds from the cotton fibres), yarning, weaving. Depending on the case, yarns and fabrics might get dyed or bleached.

Production: This is where the textiles and the clothing industry split. It comprises cutting fabrics, trimming the pieces and finishing the product. Finished clothing gets ironed and packed. Sometimes even price buttons for the contracting retailer customer can be added, making the product ready for the storefront (see Nordas 2004, p. 5).

Export: Export can be done by brand-named apparel companies, retail agents, overseas buying offices or trading companies.

Marketing: Goods are sold to the customer via different types of retailers or brand-named companies who sometimes have their own outlets or flagship stores.

Contrary to the assumptions of Pollin et al. (2002), the production of clothing is characterized by high degrees of international labor division. Vertical integration is largely absent and production takes places within many adjacent stages, and is carried out by globally dispersed, legally independent, profit maximizing companies. In the textile sector, physical separation of the different production steps, like product design and manufacturing, prevails. The planning and design of clothing production are largely located in developed countries, while a significant international relocation of manufacturing to lower cost producers around the world, and in some cases in relative geographical proximity to the major consumer market has taken place (see Nordas 2004, p.2). This requires costly informational processes, where flows of consumer demand and product information have to be transferred between intermediary producers at very different places. As intermediary goods of differing quality need to be exchanged globally, transaction costs form an important part of production costs in the clothing and textile sector.

Total market growth of clothing is small, while consumer behavior has changed insofar as frequent changes in product appearance are valued. For retailers and brands, this means more frequent interaction with suppliers about product properties. Retailers like H&M have started to offer fast changing collections of clothing. A higher frequency of transactions between buyers and suppliers with the total amount of products held constant means that the relative weight of transaction costs as a part of total costs for clothing production can be expected to increase. Information exchange and storage systems have become ever more important to save costs and organize production (see Gereffi et al. 2003, p. 6). As described by Cammett (2006, pp. 24), recent changes in the global textile industry have been mainly organizational or based on information technology. Both observed strategies (clustering and electronic data exchange) are means to reduce costs resulting from information asymmetry. In the globalized clothing value chain, transaction costs are an important source of companies’ costs. Factor prices are not the most important costs for producers.

Standards play a major role in value chain management. Production coordination is based on a common set of standardized practices or process standards (like ISO 9000) and product standards (like national regulations concerning product contents). Inclusion of certain suppliers into textile and clothing production processes depends on the use and knowledge of compatible and widely disseminated standards (see Nordas 2004, p. 5; Cammett 2006 p. 24). Interlinking production processes with new partners causes transaction costs and specific investments: “Big retailers invest significant time and resources in bringing their suppliers up to speed on their designated procurement systems and training factory management to work with computer technology and the Internet. Once they achieve an effective management system within a given factory, sourcing executives try to generalize the system over a number of supplier factories.” (Cammett 2006, p. 32).

Information on social and environmental production circumstances is available only for insiders of the production process. To ensure FT quality to the consumer, FT inputs have to be tracked throughout the entire value chain. Because of information asymmetries and incentives to cheat between buyers and sellers of intermediary products, there must be some kind of control and information system to ensure producer compliance with costly social and environmental standards. At each stage of production, within each company participating, social and environmental issues accrue and have to be controlled for by third party auditors. This results in fees which have to be paid by FT certified producers to third party FT licensing organizations like FLO-Cert.

3) The Global Value Chain Concept

In economic literature, assessments of certification generally overlook the effects of what happens if successive intermediaries are involved in the production process. Usually a simple buyer-seller (consumer-firm) relation is presupposed for exploring the economics of certificates (see for example Albano et al. 2001, pp. 267; Bonroy et al. 2004, pp. 527; Sedjo et al. 2002, pp. 272; Linnemer et al. 2000, pp. 1397; Kuhn 1999, pp. 1). This may be plausible for simpler products than clothes. But as the production of textiles is highly disintegrated and internationally dispersed, certification may lead to several potentially costly changes in complex production processes which include several independent intermediaries. To evaluate these FT certification effects on the value chain, a framework which delivers a dynamic perspective on the effects of standards implementation on global production processes will be necessary.

Economic sociology has developed a model called Global Value Chains (formerly also named Global Commodity Chains; see Gereffi et al. 1994, p. 1, Gereffi et al. 2005, pp. 78) which is concerned with the structural properties of the industry in which a specific product is produced. Global Value Chain theory systematically depicts actors and the linkages between them within production networks (value chains). The Global Value Chain (GVC) framework shows the flows of intermediary goods; services and information in order to provide a certain product (see Starmanns 2007, p. 12). The framework delivers characteristics and terminology for an analysis of certification effects. By drawing a relation between optimal chain structures and given product properties, it offers insights about value chain related cost-effects of FT certification.

Graphically and analytically, the GVC model decomposes the production process into a sequence of nodes and linkages:

Nodes capture the processing of goods or information. They comprise one value added step, or one activity that is exercised. Nodes are a separable process, either technologically or socially (see Hopkins et al. 1994, p. 18).

Linkages capture the exchange relation between nodes. These are the flows of (intermediary) goods, services and information.

The information exchange between production stages relates to the product. Following Humphrey et al. (2001, pp. 21) there are four key contractual parameters of the transaction (referred to as product parameters in this study) which define what is to be done at any point in the chain and form the content of informational flows: 1) Product definition: What is to be produced; 2) Process definition: How is it to be produced. ; 3) Time of production or delivery. 4) Amount of production or/(and) product price.

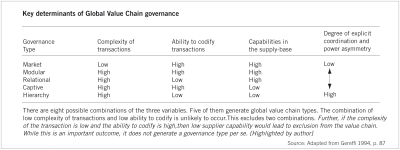

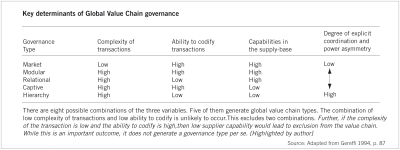

Exchange of intermediary goods, services and information can happen within different overall structural alternatives, i.e. within market, hybrid forms or hierarchies. These structures are governance systems. Global Value Chain theory describes the existence of structural similarities of industries caused by the contractual parameters of their particular products. The governance structure of the value chain follows a transaction cost economizing idea, based on given product properties. Building on Williamson's (see 1979, pp. 248) definitions of three governance types Gereffi et al. (2005, pp. 86) develop five structural forms of value chain governance: market, modular, relational, captive and hierarchical (see Figure 1 below). Modular, relational and captive governance forms are called network governance types and show similarity to Williamson’s hybrid contractual arrangements (Williamson 1991, pp. 280).

To describe the transaction cost defining properties of the product parameters of Global Value Chain exchange processes Gereffi et al. propose three variables: complexity, codifiability and supplier capability. The values of these variables determine the transaction costs within global value chains and thus the transaction cost economizing overall governance structure (see Gereffi et al. 2005, pp. 84-85). The three determinants relate to the basic unit of a single transaction along the chain and comprise two causes of transaction costs. Those described by Williamson (see e.g. 1973, pp. 317), and those created by value chain activities coordination, called mundane transaction costs (see Gereffi et al. 2005, p. 84).

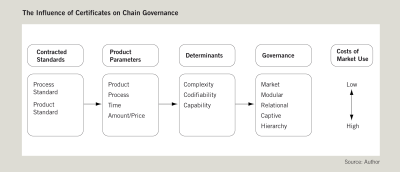

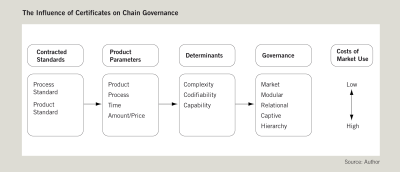

By shifting these determinants between two qualitative values (high and low), the optimal governance structure changes (see Figure 1 above), thus a dynamic perspective on value chains is made possible. As the values of the determinants of a transaction (complexity, codifiability and capability) depend on the contractual product parameters introduced by Humphrey et al. (2001, p. 22), we can now understand how standards influence the structure of Global Value Chain governance. The causal relation between standards and efficient governance structure is illustrated below. Figur 2 shows that as pointed out by Humphrey et al. (2001, p. 22), product and process standards (like FT certificates) change product parameters. Obviously, changing the parameters of transactions (process, product, time, amount/price) changes the determinants complexity, codifiability and supplier capability. If the values of the determinants change, the efficient mode of value chain governance changes.

On the right side of Figure 2 we can see generic chain transaction costs (always referred to a particular product) expressed as the costs of market use. If market structures prevail within an industry, the costs of market use must be lower than the costs of performing the same transaction within a hierarchical structure. Therefore, the changes in the efficient governance structure induced by changing the product parameters (e.g. via FT standards) can be expressed in the relative measure of the costs of market use for a certain transaction. If the transaction cost economizing industry structure was for example captive, the costs of market use for a specific transaction were comparably higher than in the case of modular industry structures.

Global Value Chain theory offers a framework to investigate the causal relation between standards, i.e. certificates and the transaction cost economizing industry governance structure. This allows predictions about the impact of Fair Trade standards, which change product attributes, on governance structures and thus transaction costs for market participants. Intuitively, the GVC model illustrates that the efforts, which are needed to organize transfers of goods or services within the chain are depending on the characteristics of the good. The kind of governance (e.g. market or hierarchy) of production sequences is designed depending on the way such efforts are minimized. A change in value chain relations, like searching new business partners, negotiating new arrangements etc. comes at high costs. Imagine a FT certificate requiring certain standards for work-place conditions. Buyers need to identify producers who are able to prove that they comply with these standard and they need to work out the best way to cooperate with their new suppliers in terms of information transfer, etc. In addition, Global Value Chain analysis predicts changes in the competitive situation within production stages. The requirements of a certain standard can lead to the exclusion of suppliers with low capabilities (in relation to the specific product parameters). This can lead to changes in the competitive structure, which in turn may lead to changes in prices for intermediary (chain) goods and services.

4) The Effect of Fair Trade Certificates on GVCs

Employing the GVC model, I will discuss the potential effects of certificates on the competitive structure in more detail.

Contracted, third party verified standards, like FT certificates, which comprise product and process standards, demand that several production stages, i.e. producers within the textile value chain comply with detailed, new requirements. Depending on the country of production and the quality demands producers have faced before, i.e. the state of the art of producers within the textile value chain, these requirements normally exceed legal and market requirements.

From a Global Value Chain perspective, Fair Trade standards influence the contractual parameters of the transaction and thus change the determinants of Global Value Chain Governance. As Gereffi et al. (2005, p. 92) have argued, the prevailing governance structure in the clothing and textile industry has moved to very market-based modular value chains in recent years, reflecting the ongoing process of vertical separation mentioned in chapter 2) (see also Gereffi 1999, pp. 37, Cammett 2006, pp. 25). Under modular governance (cf. Figure 1 above), product complexity and codifiability (which could be expected to increase through the introduction of FT standards) are already set at high values. But particularly through new requirements on suppliers at each stage, relative capabilities of potential and actual suppliers might decrease. In the GVC framework, decreasing capabilities causes a shift towards less market based network forms of governance, which from the given state of modular governance (high complexity, high ability to codify, high supplier capabilities) would lead to captive governance as being the most transaction cost economizing structure (see Figure 1). In comparison to modular governance, captive governance means that e.g. lead firms (who carry the major burden of value chain organization) need to invest more resources for consulting and supervising supply chain partners. Thus, transaction costs for sourcing certain inputs within a market context might become inefficient, and a switch to “closer” relations might economize resources for both business partners. As a result it can be argued, that taking part in a value chain for Fair Trade standardized product parameters implies higher costs of market use, as can be seen on the right side in Figure 2 which shows the influence of standards on governance.

Lowering supplier capabilities also means that some producers ultimately become excluded from the value chain, changing the competitive structure at each affected production stage. Moreover, a shift in governance towards more hierarchical, less market-based structures also implies a reduction in the number of market participants who are not contractually bound to buyers or sellers. This adds to the change in the competitive relations between processing stages. As a result, changes in competition (e.g. to a monopolistic situation) at different, interconnected stages can lead to changes in intra chain prices for intermediary goods.

These value chain effects (the change of transaction costs (expressed as the relative costs of market use) and changes in intra-chain prices) of FT certification are solely based on the fact that the production of textiles is integrated within a value chain structure, and FT standards change the contractual parameters of transaction throughout the entire chain by demanding compliance from several production stages and by demanding to exchange FT intermediary products only with other complying producers. Fair Trade actually creates a new, different value chain type, in which producers who had formerly relied on more market based sourcing structures experience higher transaction costs and changing input and output prices for (intermediary) goods.

Such value chain effects may be able to explain for the discrepancy between compliance costs calculations, such as done by Pollin et al. 2002 (who focus on the firm as an entity which is not integrated into some kind of value chain), and observed costs of the final Fair Trade certified product.

5) Conclusions

Because of the prevailing, non-vertically integrated industry structure and information asymmetries over individual producers’ social and environmental costly counterchecking of FT standards compliance needs to be undertaken by Fair Trade initiatives. Moreover the attributes of the (intermediary) textile products, i.e. the product parameters change due to certification. As Global Value Chain analysis argues, this is equivalent to a change in the product determinants and thus leads to a reorganization of the governance structure of the production process as well as to the exclusion of some producers, resulting in a change of intra chain intermediary prices and transaction costs (expressed in the costs of market use).

Introducing Fair Trade standards to an existing value chain imposes on each producer not only direct compliance costs, as argued by Pollin et al. 2002, but also certification fees to pay the control mechanisms and leads, in particular, to changed intra-chain prices and changed intra chain transaction cost, together termed (tangible and intangible) Value Chain Effects. The GVC model thus suggests an explanation for the observed discrepancy between market prices of FT textile products and the expected compliance costs.

A next step is to empirically test this hypothesis. In addition, the insights from the GVC model can be used to design optimal certificates for the textile sector. They would be optimal in the sense of minimizing the certification costs which are due to these value chain effects.

Literature:

Albano, G. L./Lizzeri, A. (2001): Strategic Certification and Provision of Quality, in: International Economic Review, Vol. 42, No. 1, pp. 267 - 283.

Arnesen, M./Selby S. (2008): Social Certification Using SA8000, accessed via: http://www.erm.com/ERM/Website.nsf/GFN/Sa8000.pdf/$file/Sa8000.pdf, November 17th, 2008.

Bonroy, O./Constantatos, C. (2003): Biens de Confiance et Concurrence en Prix: Quand Aucun Producteur ne Souhaite l'Introduction d'un Label, in: Revue Économique, Vol. 55, No. 3, pp. 527 - 532.

Cammett, M. (2006): Development and the Changing Dynamics of Global Production: Global Value Chains and Local Clusters in Apparel Manufacturing, in: Competition & Change, Vol. 10, No. 1, pp. 23 - 48.

Furubotn, E. G./Richter, R. (2005): Institutions & Economic Theory: The Contribution of the New Institutional Economics, Michigan.

Gereffi, G./ Korzeniewicz, M./Korzeniewicz, R. P. (1994): Introduction: Global Commodity Chains, in: Gereffi, G./Korzeniewicz, M. (Eds): Commodity Chains and Global Capitalism, Westport, pp. 1 - 14.

Gereffi, G. (1999): International Trade and Industrial Upgrading in the Apparel Commodity Chain, in: Journal of International Economics, No. 48, pp. 37 – 70.

Gereffi, G./Memedovic, O. (2003): The Global Apparel Value Chain: What Prospects for Upgrading by Developing Countries, Vienna.

Gereffi, G./Humphrey, J./Sturgeon, T. (2005): The Governance of Global Value Chains, in: Review of International Political Economy, Vol. 12, No. 1, pp. 78 - 104.

Grassegger, H. (2008): Certificates for the Textile Industry – A Global Value Chain Perspective on the Costs of Fair Trade Certification. University of Zürich, Masters Thesis (not published)

Hopkins, T. K./Wallerstein, I. (1994): Commodity Chains: Construct and Research, in: Gereffi, G./Korzeniewicz, M. (Eds): Commodity Chains and Global Capitalism, Westport, pp. 17 - 19.

Humphrey, J./Schmitz, H. (2001): Governance in Global Value Chains, in: IDS Bulletin (2001): The Value of Value Chains: Spreading The Gains From Globalisation, Vol. 32, No. 3, pp. 19 - 29.

Linnemer, L./Perrot, A. (2000): Une Analyse Économique des „Signes de Qualité“: Labels et Certification des Produits, in: Revue Économique, Vol. 51, No. 6, pp. 1397 - 1418.

Nicholls, A./Opal, C. (2005): Fair Trade - Market Driven Ethical Consumption, London.

Nordas, H. K. (2004): The Global Textile and Clothing Industry Post the Agreement on Textiles and Clothing. Accessed via: www.wto.org/english/res_e/booksp_e/discussion_papers5_e.pdf, November 17th, 2008.

Pfohl, H. C. (2007): India and China as Sourcing Markets. A Comparative Study for the German Textile Industry. Accessed via: http://textination.de/en/Compass/Sourcing%20Asia/India-China, May 11th, 2009

Pollin, R./Burns, J./Heintz, J. (2002): Global Apparel Production and Sweatshop Labor: Can Rising Retail Prices Finance Living Wages?, in: Cambridge Journal of Economics, (accepted), pp. 1 - 37. Accessed via: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=333325, October 1st, 2008.

Sedjo, R. A./Swallow, S. K. (2002): Voluntary Eco-Labeling and Price Premium, in: Land Economics, Vol. 87, No. 2, pp. 272 - 284.

Williamson, O. E. (1973): Markets and Hierarchies: Some Elementary Considerations, in: The American Economic Review, Vol. 63, No. 2, pp. 316 – 325.

Williamson, O. E. (1979): The Governance of Contractual Relations, in: Journal of Law and Economics, Vol. 22, No. 2, pp. 233 – 261.

Williamson, O. E. (1981): The Economics of Organization: The Transaction Cost Approach, in: American Journal of Sociology, Vol. 87, No. 3, pp. 548 – 577.

Williamson, O. E. (1991): The Analysis of Discrete Structural Alternatives, in: Administrative Science Quarterly, Vol. 36, No. 2, pp. 269 – 296.

By Hannes Grassegger

Remark: I wrote this paper for the CRASSH Workshop on Fair Trade - A Moral Economy? at Cambridge University. If you like to get the original with all the references contact me via this blog.

1) Introduction

This paper analyses the costs of Fair Trade (FT) third party certification for clothing by examining the given industry structure and applying the Global Value Chain framework.

FT clothing certification was started in 2004, and is different to FT certification for agro-commodities, as it tackles a by far more complex industry. Thus, FT textiles certification can be regarded as a test run for the expansion of the FT system on most industrial products like computers etc. Proponents of FT often praise the system as a market based solution to obtain certain social and environmental improvements.

In popular language, the expression Fair Trade has become synonymous with ethically differentiated products that rely on social and environmental standards. “There is no legal definition of Fair Trade and no protection against counterfeit Fair Trade products” (Nicholls et al. 2005, p. 230). The Fair Trade definition according to FINE reads as follows:

“Fair Trade is a trading partnership, based on dialogue, transparency and respect, that seeks greater equity in international trade. It contributes to sustainable development by offering better trading conditions to, and securing the rights of, marginalized producers and workers [highlighted by the author] – especially in the South. Fair Trade Organizations, backed by consumers, are engaged actively in supporting producers, awareness raising and in campaigning for changes in the rules and practice of conventional international trade.”

FT thus focuses on workers and producers. It promises direct and efficient transfers of money or other measurable benefits to workers within the production process of a specific FT product. FT certification for clothing has the aim of substantially improving working conditions and demands several costly compliance measures for producers, such as higher wages. We thus expect a corresponding price increase for FT certified products.

To find out “the retail price increases that would be necessary to fully absorb the costs of substantially raising wages and/or improving working conditions for production level workers in the apparel industry” Pollin et al. (2002, p. 5) analyzed retail price effects of wage increases for staff in the production of garments. Starting from aggregated data from Mexico and the US on the share of labor costs per item at the shipping stage, they increased staff wages by a 100%. Depending on the production country and depending on whether they also doubled the wages of supervisory staff, they estimated costs, which, added to the retail price should cause price rises “ranging between 2% and 6%” (Pollin et al. 2002, p. 5). Thus, to cover the costs of doubling the wages only a very small price increase should be expected. However, actual mark-ups for Fair Trade certified clothing are by far higher. Conducting internet and storefront as well as press research, I found a plethora of offers for Fair Trade certified white T-shirts showing price increases between 160% an 360% compared to a common white T-shirt from mass retailer C&A.

The goal of this paper is to explain this huge discrepancy between the observed market prices of certified textile products and the much lower price increase that could be expected due to the FT requirements. The costs of Fair Trade certification accrue partly because of the specific production circumstances of textiles and clothing. Certifying clothes is different to certifying simple products like coffee, insofar as the production processes are more complex and sequenced. The predictions of Pollin et al. (2002) were based on two premises:

- Imposing higher wages (or better working conditions) comes at no cost.

- The production of textiles is undertaken by a vertically integrated unit.

This paper shows why both premises lead to false conclusions in the context of complex value chains such as for clothes. For this, I first give a brief overview of the clothing value chain and its properties (section 2). Section 3 presents the Global Value Chain concept, on which the assessment of cost effects of certification is based and section 4 investigates these effects in detail. Section 5 concludes.

2) Properties of Textile Value Chains

Gereffi et al. (see 2003, p. 7) divide the production process of clothing into five distinct adjacent stages:

Raw Materials: e.g. farming of cotton, bamboo, hemp, jute, linen or sisal; man-made (synthetic) production of fibers; cattle breeding of different types of farm animals for wool production.

Components: The textiles industry comprises several production stages to arrive at fabrics, also depending on the raw material. Examples are ginning (removing the seeds from the cotton fibres), yarning, weaving. Depending on the case, yarns and fabrics might get dyed or bleached.

Production: This is where the textiles and the clothing industry split. It comprises cutting fabrics, trimming the pieces and finishing the product. Finished clothing gets ironed and packed. Sometimes even price buttons for the contracting retailer customer can be added, making the product ready for the storefront (see Nordas 2004, p. 5).

Export: Export can be done by brand-named apparel companies, retail agents, overseas buying offices or trading companies.

Marketing: Goods are sold to the customer via different types of retailers or brand-named companies who sometimes have their own outlets or flagship stores.

Contrary to the assumptions of Pollin et al. (2002), the production of clothing is characterized by high degrees of international labor division. Vertical integration is largely absent and production takes places within many adjacent stages, and is carried out by globally dispersed, legally independent, profit maximizing companies. In the textile sector, physical separation of the different production steps, like product design and manufacturing, prevails. The planning and design of clothing production are largely located in developed countries, while a significant international relocation of manufacturing to lower cost producers around the world, and in some cases in relative geographical proximity to the major consumer market has taken place (see Nordas 2004, p.2). This requires costly informational processes, where flows of consumer demand and product information have to be transferred between intermediary producers at very different places. As intermediary goods of differing quality need to be exchanged globally, transaction costs form an important part of production costs in the clothing and textile sector.

Total market growth of clothing is small, while consumer behavior has changed insofar as frequent changes in product appearance are valued. For retailers and brands, this means more frequent interaction with suppliers about product properties. Retailers like H&M have started to offer fast changing collections of clothing. A higher frequency of transactions between buyers and suppliers with the total amount of products held constant means that the relative weight of transaction costs as a part of total costs for clothing production can be expected to increase. Information exchange and storage systems have become ever more important to save costs and organize production (see Gereffi et al. 2003, p. 6). As described by Cammett (2006, pp. 24), recent changes in the global textile industry have been mainly organizational or based on information technology. Both observed strategies (clustering and electronic data exchange) are means to reduce costs resulting from information asymmetry. In the globalized clothing value chain, transaction costs are an important source of companies’ costs. Factor prices are not the most important costs for producers.

Standards play a major role in value chain management. Production coordination is based on a common set of standardized practices or process standards (like ISO 9000) and product standards (like national regulations concerning product contents). Inclusion of certain suppliers into textile and clothing production processes depends on the use and knowledge of compatible and widely disseminated standards (see Nordas 2004, p. 5; Cammett 2006 p. 24). Interlinking production processes with new partners causes transaction costs and specific investments: “Big retailers invest significant time and resources in bringing their suppliers up to speed on their designated procurement systems and training factory management to work with computer technology and the Internet. Once they achieve an effective management system within a given factory, sourcing executives try to generalize the system over a number of supplier factories.” (Cammett 2006, p. 32).

Information on social and environmental production circumstances is available only for insiders of the production process. To ensure FT quality to the consumer, FT inputs have to be tracked throughout the entire value chain. Because of information asymmetries and incentives to cheat between buyers and sellers of intermediary products, there must be some kind of control and information system to ensure producer compliance with costly social and environmental standards. At each stage of production, within each company participating, social and environmental issues accrue and have to be controlled for by third party auditors. This results in fees which have to be paid by FT certified producers to third party FT licensing organizations like FLO-Cert.

3) The Global Value Chain Concept

In economic literature, assessments of certification generally overlook the effects of what happens if successive intermediaries are involved in the production process. Usually a simple buyer-seller (consumer-firm) relation is presupposed for exploring the economics of certificates (see for example Albano et al. 2001, pp. 267; Bonroy et al. 2004, pp. 527; Sedjo et al. 2002, pp. 272; Linnemer et al. 2000, pp. 1397; Kuhn 1999, pp. 1). This may be plausible for simpler products than clothes. But as the production of textiles is highly disintegrated and internationally dispersed, certification may lead to several potentially costly changes in complex production processes which include several independent intermediaries. To evaluate these FT certification effects on the value chain, a framework which delivers a dynamic perspective on the effects of standards implementation on global production processes will be necessary.

Economic sociology has developed a model called Global Value Chains (formerly also named Global Commodity Chains; see Gereffi et al. 1994, p. 1, Gereffi et al. 2005, pp. 78) which is concerned with the structural properties of the industry in which a specific product is produced. Global Value Chain theory systematically depicts actors and the linkages between them within production networks (value chains). The Global Value Chain (GVC) framework shows the flows of intermediary goods; services and information in order to provide a certain product (see Starmanns 2007, p. 12). The framework delivers characteristics and terminology for an analysis of certification effects. By drawing a relation between optimal chain structures and given product properties, it offers insights about value chain related cost-effects of FT certification.

Graphically and analytically, the GVC model decomposes the production process into a sequence of nodes and linkages:

Nodes capture the processing of goods or information. They comprise one value added step, or one activity that is exercised. Nodes are a separable process, either technologically or socially (see Hopkins et al. 1994, p. 18).

Linkages capture the exchange relation between nodes. These are the flows of (intermediary) goods, services and information.

The information exchange between production stages relates to the product. Following Humphrey et al. (2001, pp. 21) there are four key contractual parameters of the transaction (referred to as product parameters in this study) which define what is to be done at any point in the chain and form the content of informational flows: 1) Product definition: What is to be produced; 2) Process definition: How is it to be produced. ; 3) Time of production or delivery. 4) Amount of production or/(and) product price.

Exchange of intermediary goods, services and information can happen within different overall structural alternatives, i.e. within market, hybrid forms or hierarchies. These structures are governance systems. Global Value Chain theory describes the existence of structural similarities of industries caused by the contractual parameters of their particular products. The governance structure of the value chain follows a transaction cost economizing idea, based on given product properties. Building on Williamson's (see 1979, pp. 248) definitions of three governance types Gereffi et al. (2005, pp. 86) develop five structural forms of value chain governance: market, modular, relational, captive and hierarchical (see Figure 1 below). Modular, relational and captive governance forms are called network governance types and show similarity to Williamson’s hybrid contractual arrangements (Williamson 1991, pp. 280).

To describe the transaction cost defining properties of the product parameters of Global Value Chain exchange processes Gereffi et al. propose three variables: complexity, codifiability and supplier capability. The values of these variables determine the transaction costs within global value chains and thus the transaction cost economizing overall governance structure (see Gereffi et al. 2005, pp. 84-85). The three determinants relate to the basic unit of a single transaction along the chain and comprise two causes of transaction costs. Those described by Williamson (see e.g. 1973, pp. 317), and those created by value chain activities coordination, called mundane transaction costs (see Gereffi et al. 2005, p. 84).

By shifting these determinants between two qualitative values (high and low), the optimal governance structure changes (see Figure 1 above), thus a dynamic perspective on value chains is made possible. As the values of the determinants of a transaction (complexity, codifiability and capability) depend on the contractual product parameters introduced by Humphrey et al. (2001, p. 22), we can now understand how standards influence the structure of Global Value Chain governance. The causal relation between standards and efficient governance structure is illustrated below. Figur 2 shows that as pointed out by Humphrey et al. (2001, p. 22), product and process standards (like FT certificates) change product parameters. Obviously, changing the parameters of transactions (process, product, time, amount/price) changes the determinants complexity, codifiability and supplier capability. If the values of the determinants change, the efficient mode of value chain governance changes.

On the right side of Figure 2 we can see generic chain transaction costs (always referred to a particular product) expressed as the costs of market use. If market structures prevail within an industry, the costs of market use must be lower than the costs of performing the same transaction within a hierarchical structure. Therefore, the changes in the efficient governance structure induced by changing the product parameters (e.g. via FT standards) can be expressed in the relative measure of the costs of market use for a certain transaction. If the transaction cost economizing industry structure was for example captive, the costs of market use for a specific transaction were comparably higher than in the case of modular industry structures.

Global Value Chain theory offers a framework to investigate the causal relation between standards, i.e. certificates and the transaction cost economizing industry governance structure. This allows predictions about the impact of Fair Trade standards, which change product attributes, on governance structures and thus transaction costs for market participants. Intuitively, the GVC model illustrates that the efforts, which are needed to organize transfers of goods or services within the chain are depending on the characteristics of the good. The kind of governance (e.g. market or hierarchy) of production sequences is designed depending on the way such efforts are minimized. A change in value chain relations, like searching new business partners, negotiating new arrangements etc. comes at high costs. Imagine a FT certificate requiring certain standards for work-place conditions. Buyers need to identify producers who are able to prove that they comply with these standard and they need to work out the best way to cooperate with their new suppliers in terms of information transfer, etc. In addition, Global Value Chain analysis predicts changes in the competitive situation within production stages. The requirements of a certain standard can lead to the exclusion of suppliers with low capabilities (in relation to the specific product parameters). This can lead to changes in the competitive structure, which in turn may lead to changes in prices for intermediary (chain) goods and services.

4) The Effect of Fair Trade Certificates on GVCs

Employing the GVC model, I will discuss the potential effects of certificates on the competitive structure in more detail.

Contracted, third party verified standards, like FT certificates, which comprise product and process standards, demand that several production stages, i.e. producers within the textile value chain comply with detailed, new requirements. Depending on the country of production and the quality demands producers have faced before, i.e. the state of the art of producers within the textile value chain, these requirements normally exceed legal and market requirements.

From a Global Value Chain perspective, Fair Trade standards influence the contractual parameters of the transaction and thus change the determinants of Global Value Chain Governance. As Gereffi et al. (2005, p. 92) have argued, the prevailing governance structure in the clothing and textile industry has moved to very market-based modular value chains in recent years, reflecting the ongoing process of vertical separation mentioned in chapter 2) (see also Gereffi 1999, pp. 37, Cammett 2006, pp. 25). Under modular governance (cf. Figure 1 above), product complexity and codifiability (which could be expected to increase through the introduction of FT standards) are already set at high values. But particularly through new requirements on suppliers at each stage, relative capabilities of potential and actual suppliers might decrease. In the GVC framework, decreasing capabilities causes a shift towards less market based network forms of governance, which from the given state of modular governance (high complexity, high ability to codify, high supplier capabilities) would lead to captive governance as being the most transaction cost economizing structure (see Figure 1). In comparison to modular governance, captive governance means that e.g. lead firms (who carry the major burden of value chain organization) need to invest more resources for consulting and supervising supply chain partners. Thus, transaction costs for sourcing certain inputs within a market context might become inefficient, and a switch to “closer” relations might economize resources for both business partners. As a result it can be argued, that taking part in a value chain for Fair Trade standardized product parameters implies higher costs of market use, as can be seen on the right side in Figure 2 which shows the influence of standards on governance.

Lowering supplier capabilities also means that some producers ultimately become excluded from the value chain, changing the competitive structure at each affected production stage. Moreover, a shift in governance towards more hierarchical, less market-based structures also implies a reduction in the number of market participants who are not contractually bound to buyers or sellers. This adds to the change in the competitive relations between processing stages. As a result, changes in competition (e.g. to a monopolistic situation) at different, interconnected stages can lead to changes in intra chain prices for intermediary goods.

These value chain effects (the change of transaction costs (expressed as the relative costs of market use) and changes in intra-chain prices) of FT certification are solely based on the fact that the production of textiles is integrated within a value chain structure, and FT standards change the contractual parameters of transaction throughout the entire chain by demanding compliance from several production stages and by demanding to exchange FT intermediary products only with other complying producers. Fair Trade actually creates a new, different value chain type, in which producers who had formerly relied on more market based sourcing structures experience higher transaction costs and changing input and output prices for (intermediary) goods.

Such value chain effects may be able to explain for the discrepancy between compliance costs calculations, such as done by Pollin et al. 2002 (who focus on the firm as an entity which is not integrated into some kind of value chain), and observed costs of the final Fair Trade certified product.

5) Conclusions

Because of the prevailing, non-vertically integrated industry structure and information asymmetries over individual producers’ social and environmental costly counterchecking of FT standards compliance needs to be undertaken by Fair Trade initiatives. Moreover the attributes of the (intermediary) textile products, i.e. the product parameters change due to certification. As Global Value Chain analysis argues, this is equivalent to a change in the product determinants and thus leads to a reorganization of the governance structure of the production process as well as to the exclusion of some producers, resulting in a change of intra chain intermediary prices and transaction costs (expressed in the costs of market use).

Introducing Fair Trade standards to an existing value chain imposes on each producer not only direct compliance costs, as argued by Pollin et al. 2002, but also certification fees to pay the control mechanisms and leads, in particular, to changed intra-chain prices and changed intra chain transaction cost, together termed (tangible and intangible) Value Chain Effects. The GVC model thus suggests an explanation for the observed discrepancy between market prices of FT textile products and the expected compliance costs.

A next step is to empirically test this hypothesis. In addition, the insights from the GVC model can be used to design optimal certificates for the textile sector. They would be optimal in the sense of minimizing the certification costs which are due to these value chain effects.

Literature:

Albano, G. L./Lizzeri, A. (2001): Strategic Certification and Provision of Quality, in: International Economic Review, Vol. 42, No. 1, pp. 267 - 283.

Arnesen, M./Selby S. (2008): Social Certification Using SA8000, accessed via: http://www.erm.com/ERM/Website.nsf/GFN/Sa8000.pdf/$file/Sa8000.pdf, November 17th, 2008.

Bonroy, O./Constantatos, C. (2003): Biens de Confiance et Concurrence en Prix: Quand Aucun Producteur ne Souhaite l'Introduction d'un Label, in: Revue Économique, Vol. 55, No. 3, pp. 527 - 532.

Cammett, M. (2006): Development and the Changing Dynamics of Global Production: Global Value Chains and Local Clusters in Apparel Manufacturing, in: Competition & Change, Vol. 10, No. 1, pp. 23 - 48.

Furubotn, E. G./Richter, R. (2005): Institutions & Economic Theory: The Contribution of the New Institutional Economics, Michigan.

Gereffi, G./ Korzeniewicz, M./Korzeniewicz, R. P. (1994): Introduction: Global Commodity Chains, in: Gereffi, G./Korzeniewicz, M. (Eds): Commodity Chains and Global Capitalism, Westport, pp. 1 - 14.

Gereffi, G. (1999): International Trade and Industrial Upgrading in the Apparel Commodity Chain, in: Journal of International Economics, No. 48, pp. 37 – 70.

Gereffi, G./Memedovic, O. (2003): The Global Apparel Value Chain: What Prospects for Upgrading by Developing Countries, Vienna.

Gereffi, G./Humphrey, J./Sturgeon, T. (2005): The Governance of Global Value Chains, in: Review of International Political Economy, Vol. 12, No. 1, pp. 78 - 104.

Grassegger, H. (2008): Certificates for the Textile Industry – A Global Value Chain Perspective on the Costs of Fair Trade Certification. University of Zürich, Masters Thesis (not published)

Hopkins, T. K./Wallerstein, I. (1994): Commodity Chains: Construct and Research, in: Gereffi, G./Korzeniewicz, M. (Eds): Commodity Chains and Global Capitalism, Westport, pp. 17 - 19.

Humphrey, J./Schmitz, H. (2001): Governance in Global Value Chains, in: IDS Bulletin (2001): The Value of Value Chains: Spreading The Gains From Globalisation, Vol. 32, No. 3, pp. 19 - 29.

Linnemer, L./Perrot, A. (2000): Une Analyse Économique des „Signes de Qualité“: Labels et Certification des Produits, in: Revue Économique, Vol. 51, No. 6, pp. 1397 - 1418.

Nicholls, A./Opal, C. (2005): Fair Trade - Market Driven Ethical Consumption, London.

Nordas, H. K. (2004): The Global Textile and Clothing Industry Post the Agreement on Textiles and Clothing. Accessed via: www.wto.org/english/res_e/booksp_e/discussion_papers5_e.pdf, November 17th, 2008.

Pfohl, H. C. (2007): India and China as Sourcing Markets. A Comparative Study for the German Textile Industry. Accessed via: http://textination.de/en/Compass/Sourcing%20Asia/India-China, May 11th, 2009

Pollin, R./Burns, J./Heintz, J. (2002): Global Apparel Production and Sweatshop Labor: Can Rising Retail Prices Finance Living Wages?, in: Cambridge Journal of Economics, (accepted), pp. 1 - 37. Accessed via: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=333325, October 1st, 2008.

Sedjo, R. A./Swallow, S. K. (2002): Voluntary Eco-Labeling and Price Premium, in: Land Economics, Vol. 87, No. 2, pp. 272 - 284.

Williamson, O. E. (1973): Markets and Hierarchies: Some Elementary Considerations, in: The American Economic Review, Vol. 63, No. 2, pp. 316 – 325.

Williamson, O. E. (1979): The Governance of Contractual Relations, in: Journal of Law and Economics, Vol. 22, No. 2, pp. 233 – 261.

Williamson, O. E. (1981): The Economics of Organization: The Transaction Cost Approach, in: American Journal of Sociology, Vol. 87, No. 3, pp. 548 – 577.

Williamson, O. E. (1991): The Analysis of Discrete Structural Alternatives, in: Administrative Science Quarterly, Vol. 36, No. 2, pp. 269 – 296.

hannes1 - 2. Jun, 00:31